Selling a property is not only a financial challenge, but also a legal one. Many owners ask themselves what taxes are involved, what legal steps are necessary and whether they should handle the sale privately or with an estate agent. In this article, we explain the most important aspects you need to consider when selling a property.

Speculation tax on property sales: when and how it is due

The speculation tax can cause considerable costs when a property is sold. This tax is payable under certain conditions and should be taken into account when deciding to sell.

- When is speculation tax due?

- If the property is resold within ten years of purchase.

- Exceptions: If the owner has lived in the property for the last two years and in the year of sale.

- Speculation tax can also be waived for inherited properties if the testator has already owned the property for more than ten years.

- How is speculation tax calculated?

- The basis is the profit from the sale, i.e. the difference between the purchase price and the sale price.

- Income-related expenses such as estate agent fees, renovation costs and notary fees can be deducted.

- The speculation tax is based on the seller's personal income tax rate, which can be up to 45 % (top tax rate in Germany).

- Example: If a property is sold after five years for 100,000 euros more than it was bought for, a considerable tax burden can arise - depending on the tax rate.

- In the event of a very high increase in value, the tax burden can be considerable, which is why careful planning is advisable.

Tip: If you want to sell a property, you should check the holding period carefully and seek tax advice to avoid unnecessary costs. A tax advisor can help to identify legal opportunities for tax optimisation.

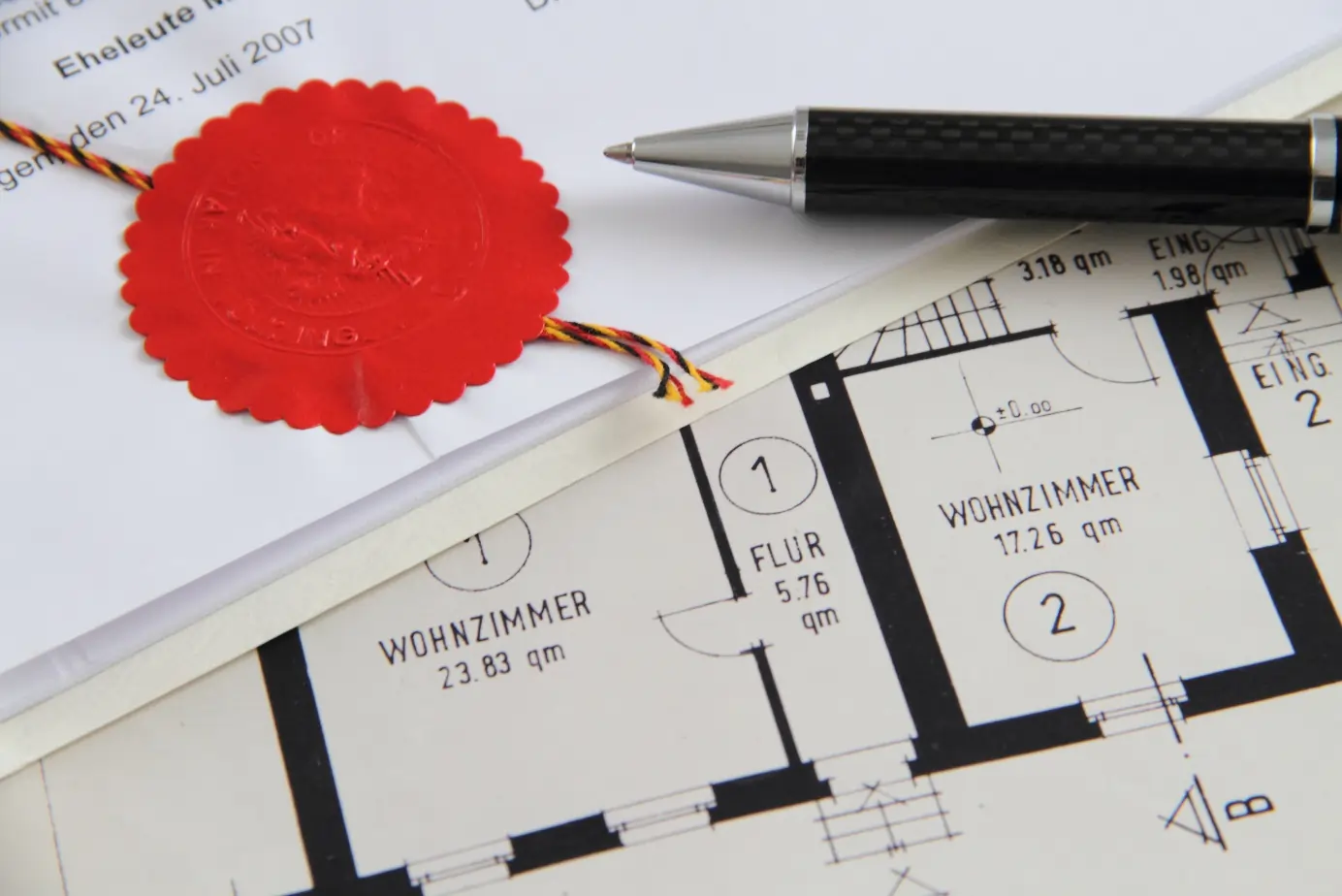

Notary, land register & co: these legal steps are necessary when selling

A property sale in Germany requires a number of legal steps that must be carefully observed:

Notarisation:

- In Germany, a notarised purchase contract is mandatory.

- The notary ensures that the transaction is legally compliant and checks the contents of the contract.

- It ensures that there are no outstanding charges or disputes that could jeopardise the sale.

Apply for an extract from the land register:

- The seller must provide a current extract from the land register.

- This contains all relevant information about the property, such as ownership structure and any encumbrances.

- If there are still land charges or mortgages, these must be clarified before the sale.

Create a draft purchase agreement

- The notary draws up a draft contract on the basis of the negotiations.

- Buyers and sellers should check the draft thoroughly and have it adapted if necessary.

- Special agreements, such as the takeover of furniture or renovation work, should be set out in detail in the contract.

Notarisation and entry in the land register:

- After signing, the notary takes care of the transfer in the land register.

- The final transfer of the property only takes place after registration and payment of the purchase price.

- In addition, the real estate transfer tax must be paid by the buyer before the transfer can be finalised.

Tip: A property sale is not legally binding without a notary. You should therefore find out about the process at an early stage and instruct a competent notary. Obtaining a financing confirmation from the buyer can also be useful in order to minimise financial risks.

Private sale or via an estate agent? The legal differences

Whether a property is sold privately or with an estate agent has not only financial but also legal implications. Both options have their advantages and disadvantages:

Private sale:

- The seller is responsible for marketing, viewings and negotiations.

- Legal pitfalls, such as incorrect contract drafting or inadequate buyer checks, can occur.

- No broker's commission, but increased time expenditure and potential legal risks.

- The seller must take care of the buyer's credit check himself in order to avoid payment defaults.

- Without professional support, it can be more difficult to achieve the optimum sales price

Sale with estate agent:

- The estate agent takes care of the entire process, from valuation and marketing to contract negotiations.

- An experienced broker knows the legal requirements and minimises the risk of errors.

- The estate agent's commission can be between 3 % and 7 % of the purchase price, depending on the region.

- An estate agent has a broad network and can find potential buyers more quickly.

- Professional marketing (high-quality photos, exposés, viewing appointments) can make the sales process considerably easier.

Tip: If you don't want to deal with the complex legal requirements, you should commission a real estate agent. Especially in difficult market phases, an estate agent can help to achieve the best possible price. A qualified estate agent can also help to screen potential buyers in advance to avoid problems later on.

Conclusion

Selling a property is a legally and fiscally complex process that requires careful preparation. Important points are

- The speculation tax can cause considerable costs if the property is sold before the ten-year period has expired. Long-term planning can help to avoid unnecessary tax payments.

- Notarisation and entry in the land register are required by law and should not be neglected. An experienced notary can facilitate the sales process and avoid potential legal problems.

- Whether you sell privately or with an estate agent depends on your own knowledge and the desired effort. A broker can optimise the sales process and minimise legal risks.

Would you like to sell your property and protect yourself legally? Contact us for a non-binding consultation - we will be happy to help you!