Buying a property is a significant investment and it is essential to ensure that there are no legal or financial surprises waiting for you. In this blog post, you will find out what measures are taken to avoid legal problems, whether the seller can subsequently withdraw from the contract and what happens if your financing is not in place on time.

1. how is it ensured that there are no legal problems?

When buying a property, there are numerous legal aspects that need to be checked in advance to avoid problems later on. Here are some of the most important points:

1.1 The notary as the central authority

In Germany, it is a legal requirement that property purchases are notarised by a notary. The notary takes on a neutral role and ensures that both parties understand their rights and obligations. His tasks include

- Checking the land register for existing encumbrances such as mortgages or land charges.

- Clarification of ownership and any pre-emptive rights.

- The proper drafting of the purchase contract in accordance with the legal requirements.

- The deposit of the purchase price in a notary escrow account, if this is agreed.

1.2 Land register check

The land register provides information about the legal situation of the property. The following points must be checked before purchase:

- Ownership structure:Is the seller really the legal owner?

- Land charges and mortgages:Are there any outstanding liabilities?

- Rights of way or easements:Are third parties allowed to enter or use the property?

- Rights of first refusal:Do third parties have the right to acquire the property before you?

A notary or property expert can help you to check these points in detail.

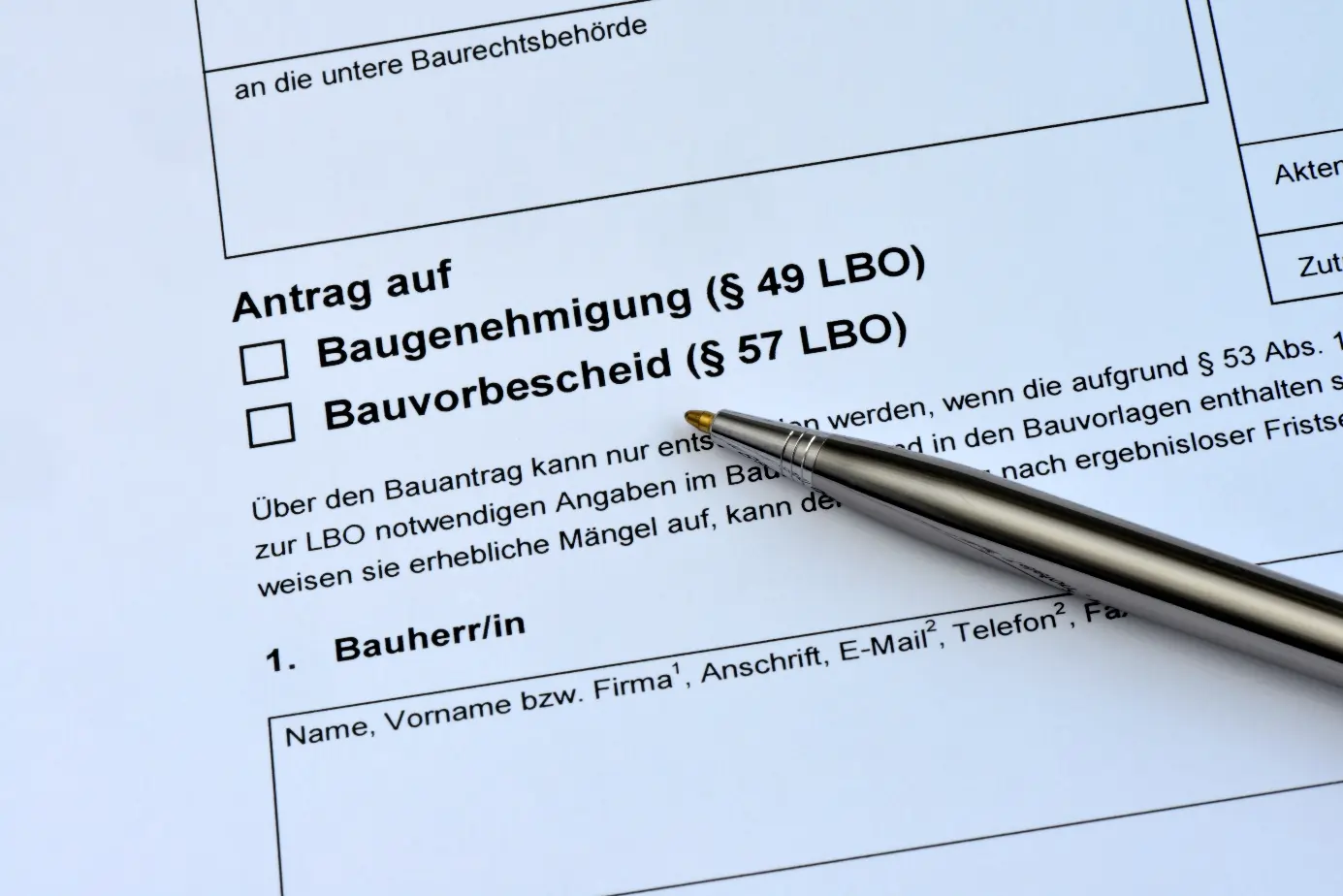

1.3 Building permits and contaminated sites

If alterations have been made to the property, it should be checked whether these are authorised. Illegal extensions can lead to considerable problems. It should also be ensured that there are no contaminated sites such as environmental pollution on the property.

1.4 Binding contract design

A clearly formulated purchase contract is essential to avoid disputes later on. All details regarding the property, payment and any defects should be recorded in writing.

2. can the seller subsequently withdraw from the contract?

Once the purchase contract has been notarised, it is usually binding for both parties. Nevertheless, there are some situations in which the seller can withdraw from the contract under certain circumstances:

2.1 Cancellation in the event of late payment

The seller can withdraw from the contract if the buyer does not pay the purchase price within the agreed period. This is stipulated in the purchase contract and represents an important protective measure for the seller.

2.2 Pre-contractual agreements and cancellation rights

In rare cases, cancellation rights are contractually stipulated, for example if certain conditions are not met (e.g. outstanding building permits or unresolved land register entries). Without such a clause, however, cancellation is not possible without further ado.

2.3 Right of cancellation for consumer protection contracts

If the seller is a commercial seller, the buyer may be entitled to a 14-day right of cancellation under certain conditions. However, this right does not usually apply to private sales.

2.4 Special cases such as deception or fraudulent defects

If the buyer can prove that the seller fraudulently concealed defects or deliberately misled him, it may be possible to contest the purchase contract. However, this can lead to lengthy legal disputes.

3. what happens if the financing is not in place in time?

Financing is one of the most important aspects of buying a property. If the loan is not provided on time, this can have serious consequences.

3.1 Financing commitment from the bank

To minimise the risk of the purchase falling through, a binding financing commitment from the bank should be obtained before the contract is signed. This confirms that the bank is prepared to grant the loan under certain conditions.

3.2 Cancellation in the event of financing problems

Some purchase contracts contain a so-called Financing reservation clause. This allows the buyer to withdraw from the contract if he does not receive financing. If there is no such clause, however, the buyer remains obliged to pay.

3.3 Delay in payment by the Bank

Even if the financing is approved, there may be delays in disbursement. In this case, you should:

- Clarify with the bank at an early stage which documents are still required.

- If necessary, an extension of the payment deadline can be negotiated with the seller.

If the buyer is unable to pay for the property on time, there is a risk of default interest or even cancellation of the contract by the seller.

3.4 Consequences of breach of contract

If the buyer does not pay despite the conclusion of the contract and without financing, the seller can claim compensation. This may include the following:

- Default interest on the purchase price

- Compensation for any brokerage costs

- Possible difference between the original purchase price and a later realised sales price

Conclusion

Buying a property is a complex process that should be well secured. Legal problems can be avoided by thoroughly checking the land register, building permits and the purchase contract. Cancellation by the seller is only possible under certain conditions, while a lack of financing can have serious consequences.

To be on the safe side, buyers should obtain a financing commitment at an early stage and, if necessary, have cancellation clauses included in the contract. Careful planning and professional advice can help to avoid unpleasant surprises and ensure a safe purchase.