Buying a property is a big decision that needs to be well thought through. Many buyers are unsure about the steps they need to take before buying, how a viewing works and what documents are required. In this blog post, we explain the entire process - from preparation to signing the contract.

1. what steps do I have to go through before I can buy a property?

Before you buy a property, you should prepare yourself thoroughly. These are the most important steps:

1.1 Determine financial planning and budget

Before you start looking for a property, you need to determine your budget. You should bear the following points in mind:

- Equity capitalBanks usually require that you can finance at least 10-20 % of the purchase price yourself.

- Obtain a financing offerConsult your bank or an independent financial advisor to find out how much you can afford to borrow.

- Plan for additional costsIn addition to the purchase price, there are notary fees, land transfer tax, estate agent fees and possibly renovation costs.

1.2 Finding the right property

As soon as your budget is set, the search for the right property begins. We can help you with this:

- Property portals such as ImmoScout24 or eBay classifieds

- Estate agencies with expertise in your desired region

- Advertisements in newspapers or notices in neighbourhoods

Consider in advance which criteria your property should fulfil: Location, size, furnishings and any modernisation requirements.

1.3 Securing financing

Before you make a binding purchase of a property, you should obtain a financing commitment from your bank. This is usually issued as a „financing confirmation“ and shows the seller that you can afford the property.

1.4 Arranging viewing appointments

Have you found an interesting property? Then it's time to arrange a viewing appointment. In the next section, we explain exactly how a viewing works and what you should look out for.

2 How does a viewing work - and what should I bear in mind?

The viewing is a crucial moment in the buying process. Here you have the opportunity to take a close look at the property and recognise possible defects at an early stage. This is how a typical viewing works:

2.1 Preparation for the inspection

- Create checklistMake a note of any questions about the property (e.g. condition of the building fabric, recent renovations, energy efficiency).

- Check land register extract and exposé: Find out in advance about the ownership structure, year of construction and special features.

- Take an expert with youIf you are unsure, you can consult a building expert or architect.

2.2 On-site inspection

- First impression and situation assessment: Get an idea of the surroundings. What is the infrastructure like? Are there shopping facilities, schools or public transport nearby?

- Check building fabricLook out for cracks in the walls, damp, mould or defective windows.

- Inspecting technical systems: Have the heating system, electrics and water pipes shown to you.

- Test the feeling of livingDo you feel comfortable in the rooms? Is the orientation of the flat ideal for natural light?

2.3 Follow-up of the inspection

- Take notesWrite down all the advantages and disadvantages of the property.

- Comparison with other objectsView several properties in order to make an informed decision.

- Consider a second visitIf you are seriously interested, visit the property again, ideally at a different time of day.

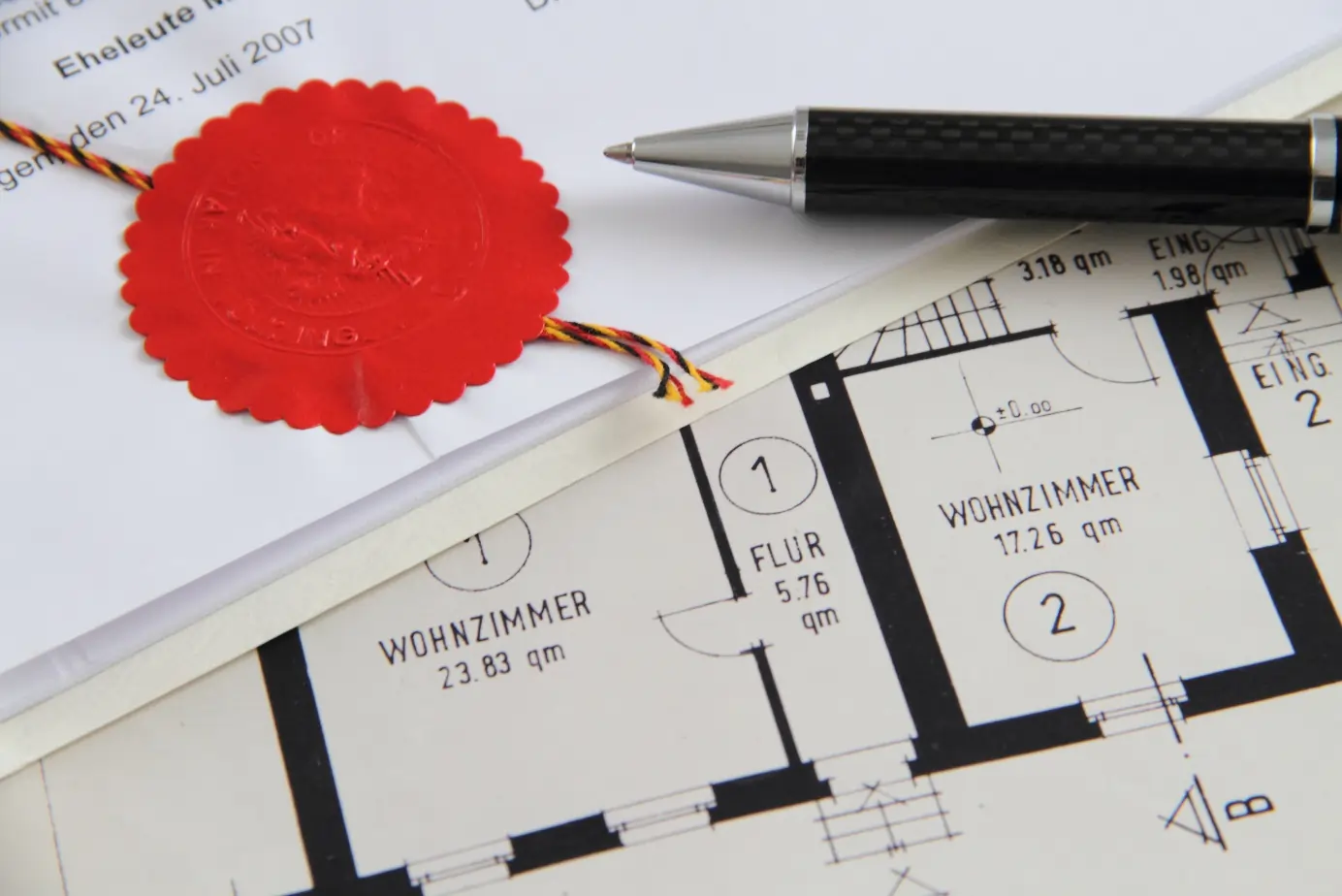

3. what documents do I need to buy a property?

Once you have decided on a property, you will need to submit a number of documents to complete the purchase process. These differ depending on whether you are buying a property as a private individual or with financing.

3.1 Important documents for the purchase

- Purchase contractThis is drawn up by the notary and contains all the important details of the purchase (purchase price, payment modalities, handover).

- Land register extractShows whether the property is unencumbered or whether there are still encumbrances such as mortgages.

- Energy certificate: Provides information about the energy efficiency of the building.

- Declaration of division (for condominiums)If you are buying a flat, you need to know which special and common property parts exist.

- Building documents and modernisation certificatesIf the building has been renovated in the past, all relevant documents should be available.

- Service charge settlementsShows the running costs you will incur.

3.2 Additional documents for financing

If you require financing, the bank will ask for additional documents:

- Proof of income (payslips for the last few months)

- Schufa information

- Credit agreement with the bank

- Property exposé incl. pictures and floor plan

Conclusion

Buying a property is a complex but easy-to-plan process. If you set your budget early on, carry out a thorough inspection and have all the necessary documents ready, nothing will stand in the way of a successful purchase. Use the expertise of professionals such as estate agents, notaries and financial advisors to avoid potential pitfalls. With the right preparation, you can ensure that you find a property that meets your requirements and represents a good long-term investment.